- Homes for Sale Ocean Club Estates Bahamas

- Realty in The Bahamas

- Real Estate Agent in The Bahamas (2026) | Call Glenn Ferguson — BREA + Bahamas MLS

- Bimini Bahamas Real Estate for Sale

- Nassau Bahamas Homes for Sale

- Real Estate Buyers Advantage Program Membership (Discounted)

- Love Estates Condos for Sale Fact Sheet

- Love Estates Condos for Sale

- Legendary Marina Resort at Blue Water Cay | Nassau Bahamas

- Honeycomb Albany Bahamas for Sale

- September 2024 for Sale Listings

- Rosewood Baha Mar Residences for Sale

- Love Estates Townhouses for Sale Fact Sheet

- Love Estates Townhouses for Sale

- Andros Island Bahamas Real Estate

- Bahamas Real Estate

- House for Sale Bahamas

- 7 Things You Must Know Before Buying Real Estate in The Bahamas

- Glenn

- Mortage Prequaification Calculator

- Bahamas Beachfront Property for Sale

- Bahamas Real Estate Buyer’s Toolkit

- Baker's Bay Condos for Sale

- Luxury Homes for Sale in Nassau Bahamas

- Bahamas Vacation Homes for Sale

- Waterfront Homes in The Bahamas

- Bahamas Real Estate Agent

- Purchasing Property in The Bahamas

- Eleuthera Real Estate for Sale

- Cheap Homes for Sale in Eleuthera Bahamas

- Bahamas Real Estate

- Can a foreigner buy a house in the Bahamas

- Palm Cay Bahamas Homes for Sale

- Bahamas Residency

- Buy Property Nassau Bahamas

- February 2025 Listings

- Kamalame Cay Bahamas

- Bahamas Market Report 2025

- Guide to Buying Property in The Bahamas

- Eleuthera Bahamas Real Estate for Sale

- Eleuthera Homes for Sale

- Buying Real Estate in Eleuthera Bahamas

- Eleuthera Beachfront Property for Sale

- Glenn The Bahamas Luxury Authority

- Bahamas Property Tax Calculator

- Understanding Bahamas Property Taxes

- Cost of Building a House in the Bahamas

- Bahamas Residency by Investment Calculator

- Bahamas Real Estate 7 Day Coaching Program

- Bahamas Mortgage

- Are You Eligible for Bahamas Residency

- Bahamas Residency Through Real Estate (2026) | Glenn Ferguson — Licensed Agent & Consultant<

- Palm Cay Bahamas Investment Guide

- Bahamas Luxury Real Estate Investment & Rental Income

- The Smart Investor's Guide to Gaining Bahamas Residency Through Real Estate 2025 Edition

- investing in paradise bahamas real estate 2025

- Nassau's Most Exclusive Neighborhoods: Lyford Cay, Albany, and Ocean Club Estates

- Bahamas Mortgage Calculator

- Comprehensive Bahamas Real Estate Links Directory

- The Smart Investor's Path to Bahamas Residency: Unlock Tax-Free Living Through Real Estate in 2025

- Four Seasons Ocean Club Residences Bahamas

- Ocean Club Four Seasons Residences Bahamas | Pre-Construction Luxury Condos

- Four Seasons Ocean Club Residences - Paradise Island Luxury

- Nassau's #1 Luxury Real Estate Authority

- The Ocean Club Four Seasons Residences Bahamas

- Four Seasons Bahamas Residences

- Bahamas Property Investment Guide

- Complete Guide to Buying Real Estate in Nassau

- Paradise Island Real Estate 2025

- Cheap Houses for Sale in the Bahamas

- Affordable Homes in the Bahamas

- Beachfront Homes for Sale in the Bahamas

- Why Invest in Bahamas Real Estate in 2025? Top 6 Reasons

- Why the Bahamas is a Hotspot for Sky-High Airbnb Profits in 2025

- Real Estate Agent in Bahamas

- Benefits of Owning Property in The Bahamas

- Pros and Cons of Owning Property in The Bahamas (2025 Update)

- Bahamas Residency: A Smarter Alternative to Renouncing US Citizenship

- Bahamas Property Search Directory

- Bahamas Residency for US Citizens: Tax Benefits 2025

- Four Seasons Residences Bahamas — VIP Buyer’s Agent & Residency Consultant | Glenn Ferguson

- Four Seasons Ocean Club Residences Bahamas | Glenn Ferguson Real Estate Agent & Residency Consultant

- Real Estate Agent in Bahamas – Glenn Ferguson

- Real Estate Agent Exuma — Glenn Ferguson | Luxury Property & Residency Consultant

- Real Estate Agent Bahamas – Glenn Ferguson | Luxury Property & Residency Consultant

- Buy Real Estate in The Bahamas – Work with Glenn Ferguson | Luxury Agent & Residency Consultant

- Albany Bahamas Real Estate – Luxury Homes, Villas & Marina Residences | Glenn Ferguson

- Houses for Sale Paradise Island Bahamas — Glenn Ferguson

- Aqualina Bahamas – Oceanfront Condos on Cable Beach | Work with Glenn Ferguson

- Homes for Sale in Paradise Island, Bahamas | Glenn Ferguson

- Homes for Sale in Nassau, Bahamas | Glenn Ferguson

- One Cable Beach vs Goldwynn vs Aqualina – Bahamas Luxury Condo Comparison

- One Cable - Aqualina - Goldwynn VIP Shortlist

- One Cable Beach Condos for Sale in Nassau Bahamas

- Bahamas Residency by Property 2025: Min Investment & Timeline

- Luxury Oceanfront Villas in the Bahamas – 2025 Buyer’s Guide & Residency Tips

- Bahamas Residency by Investment Real Estate 2026 | Qualifying Properties | Glenn Ferguson

- Luxury Bahamas Real Estate for Sale | Glenn Ferguson

- Legendary Blue Water Cay Marina Nassau – Premium Wet Slips & Cat-5 Dry Storage | Glenn Ferguson

- Single Family Homes for Sale in The Bahamas (2025) | Nassau, Paradise Island, Eleuthera, Exuma

- New Price & Featured Bahamas Real Estate Listings September 2025

- Top Real Estate Agent in The Bahamas (2026) | Glenn Ferguson — Licensed, BREA + Bahamas MLS

- Old Fort Bay Bahamas Homes for Sale – Glenn Ferguson Real Estate & Residency Consultant

- How to Buy a House in The Bahamas (Step-by-Step 2025)

- Scotland Cay Lots for Sale — Oceanfront & Oceanview

- Bahamas Sold & Under Contract September | Glenn Ferguson

- Own a Reef at Atlantis Condo – Paradise Island’s Top Income Property

- VIP Property Match & Bahamas Residency Fast-Track | Glenn Ferguson

- Glenn’s VIP Buyer’s Playbook — Bahamas Luxury Real Estate & Residency

- Featured Bahamas Luxury Listings (October 2025) — Atlantis, Baha Mar, Exuma & Private Island | Glenn Ferguson

- Paradise Island vs Cable Beach 2025 — Where to Buy Bahamas Luxury Property

- Bahamas Marina Boat Slips for Sale | Paradise Island, Palm Cay & Bimini (2025)

- Beachfront Condos for Sale in The Bahamas — 2025 Listings & Prices | Glenn Ferguson

- Indian Investors: Bahamas Residency by Investment (2026)

- Residency

- Rocky Pine off Carmichael Nassau Bahamas | New Construction Income Property Investment

- Palm Cay, Nassau Bahamas (2026) — Marina Community, Beach Club & Homes for Sale

- Bahamas Berthing Strategy for Cal & Pam Nicholson

- Albany Bahamas Permanent Residency: 2026 Luxury Guide

- Living in Nassau Bahamas (2026) | Luxury Homes & Residency Guide

- Jack’s Bay Club Eleuthera Real Estate | Luxury Oceanfront Homes

- Rocy Pine Inquiry

- GoldWynn Condos for Sale — Nassau Bahamas (Live MLS & Prices)

- Why Now Is the Smartest Time to Buy in the Bahamas (2026)

- Windsor Lakes Home Expo 2025 – Tour Nassau’s Newest Lakeside Community with Glenn Ferguson

- Bahamas Residency by Investment 2026 – Luxury Real Estate Investor’s Guide | Glenn S. Ferguson

- Bahamas Real Estate Taxes 2026 – Complete Guide for Buyers & Investors

- Aqualina Cable Beach Luxury Rentals | Oceanfront Residences Nassau Bahamas

- Aqualina Bahamas – Luxury Beachfront Condos for Indian & NRI Investors | Glenn S. Ferguson

- Aqualina Bahamas – Luxury Beachfront Condos for Canadian Investors & Snowbirds | Glenn S. Ferguson

- Aqualina Bahamas – Luxury Beachfront Condos for U.S. Buyers & Investors | Glenn S. Ferguson

- Bahamas Luxury Homes & Oceanfront Property Collection | Glenn Ferguson

- Bahamas Beachfront Property for Sale | Hand-Picked Oceanfront Homes & Condos

- Palm Cay Bahamas Homes for Sale (Marina & Beachfront Community) | Glenn Ferguson

- Palm Cay Nassau Homes for Sale | Marina, Beachfront, Lots & Dock Slips | VIP Tour

- Bahamas Homes, Condos & Investment Properties for Sale

- Glenn Ferguson — #1 Bahamas Real Estate Expert & Residency Advisor (2026)

- Bahamas Real Estate Agent — Who to Call to Buy Property Safely (2026)

- Buy Property in the Bahamas (Foreign Buyers Guide 2026) | Glenn Ferguson

- Bahamas Real Estate for Local Buyers (2026) | Glenn Ferguson

- Buying a House in The Bahamas (2026 Guide) | Glenn Ferguson — Licensed Real Estate Agent, BREA Member & Residency Consultant

- Condos for Sale in the Bahamas (2026 Buyer Guide) | Glenn Ferguson

- Paradise Island Condos for Sale (2026) | Glenn Ferguson — Verified Bahamas MLS

- Cable Beach Bahamas Condos (2026) | Glenn Ferguson — Baha Mar Area MLS

- Ask Glenn: Bahamas Real Estate Questions for Local Buyers (2026) | Nassau + Family Islands

- Bahamas Real Estate for Sale

Bahamas Property Taxes

Call 1-(242)-395-8495

Understanding Bahamas Property Taxes - Glenn Ferguson

Call or WhatsApp 1-(242)-395-8495 to Learn about Bahamas property taxes, including Stamp Duty, exemptions, and tax-saving tips.

Bahamas Property Taxes

As a luxury Bahamas real estate agent and residency consultant, I’ve guided many clients through the ins and outs of property ownership in the Bahamas. Investing in real estate here offers opportunities for luxury living, financial benefits, and even residency. However, understanding the property tax landscape is essential for making informed decisions.

Hello. I'm Glenn Ferguson, a Luxury Bahamas Real Estate Agent and Residency Consultant. Let me walk you through the key aspects of Bahamas property taxes. If you’re considering investing in Bahamas real estate, complete the form below to get our Exclusive Listing of Bahamas Luxury Properties for sale.

Use our FREE Bahamas Property Tax Calculator to Estimate Your Stamp Duty and Annual Property Tax in Seconds.

1. Stamp Duty on Property Transactions

Stamp Duty, also known as transfer tax, is a significant cost when purchasing property in the Bahamas. This tax is applied to the transaction value and is usually shared equally between the buyer and the seller unless otherwise agreed. Here’s the breakdown:

-

Up to $100,000: 2.5% of the property value.

-

Above $100,000: 10% of the property value.

For example, if you purchase a property worth $2 million, the Stamp Duty would be 10%, amounting to $200,000, split between the buyer and seller.

2. Annual Real Property Tax

The Bahamas imposes an annual tax on real estate based on the property’s market value. Rates differ depending on the type and value of the property:

-

Owner-Occupied Residential Properties:

-

First $250,000: Tax-exempt.

-

$250,001 to $500,000: 0.625%.

-

$500,001 to $5,000,000: 1%.

-

Over $5,000,000: Capped at $60,000 annually.

-

-

Vacant Land (owned by non-Bahamians):

-

First $7,000: $100 flat fee.

-

Over $7,000: 1.5%.

-

-

Commercial Properties:

-

Taxed at 0.75% of market value.

-

For luxury homeowners, the cap on owner-occupied residential properties can lead to substantial savings, especially for properties valued over $6 million.

Use our FREE Bahamas Property Tax Calculator to Estimate Your Stamp Duty and Annual Property Tax in Seconds.

3. Exemptions and Special Considerations

-

First-Time Homebuyers:

-

Bahamian citizens purchasing their first home may qualify for exemptions on Stamp Duty and annual property taxes, depending on the property’s value.

-

-

Family Islands Properties:

-

Properties on Family Islands may be eligible for reduced tax rates or exemptions to promote development.

-

-

Charitable Organizations:

-

Properties owned by registered charities are exempt from property taxes.

-

4. Payment Deadlines and Penalties

Property taxes are due annually by December 31. Late payments result in penalties and interest charges, so timely payment is crucial.

-

Penalties: Typically 5% of the unpaid amount.

-

Interest: 1.5% per month on outstanding balances.

I always recommend setting up reminders or opting for early payments to avoid penalties.

5. Process for Valuation and Payment

-

Valuation:

-

Properties are assessed by the Bahamas Department of Inland Revenue to determine market value.

-

Owners can challenge valuations they believe to be inaccurate.

-

-

Payment Methods:

-

Taxes can be paid online through the Department of Inland Revenue’s portal or in person at designated government offices.

-

6. Why Property Taxes in the Bahamas Are Attractive

The Bahamas’ property tax system is designed to attract foreign investors and high-net-worth individuals. Key benefits include:

-

No Inheritance Tax: Assets can be passed to heirs without additional tax burdens.

-

No Capital Gains Tax: Profits from selling property are not taxed.

-

Predictable Annual Costs: The capped annual tax for luxury properties ensures cost transparency.

7. Tips for Managing Property Taxes

-

Consult a Local Attorney: Expert advice ensures compliance with tax laws.

-

Plan for Closing Costs: Budget for Stamp Duty and other fees when purchasing property.

-

Monitor Property Valuations: Stay informed about your property’s assessed value to anticipate tax changes.

-

Leverage Exemptions: Work with a real estate advisor to identify tax-saving opportunities.

As someone who has worked extensively with luxury real estate and residency in the Bahamas, I understand the importance of navigating the property tax system effectively. With low tax rates and favorable exemptions, the Bahamas offers an appealing environment for investors. By staying informed and partnering with trusted professionals, you can enjoy the full benefits of property ownership.

If you’re considering investing in Bahamas real estate, let’s talk. Schedule a consultation with me today.

Looking for specific advice on tax-saving strategies? Contact me directly to discuss your options.

Ready to explore exclusive luxury properties? View our premium listings here.

Use our FREE Bahamas Property Tax Calculator to Estimate Your Stamp Duty and Annual Property Tax in Seconds.

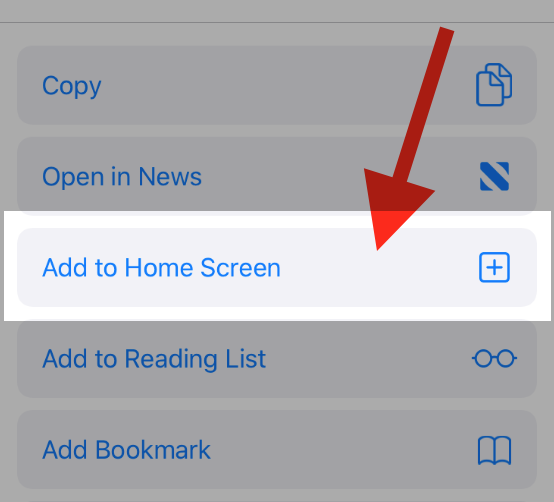

To add this web app to your homescreen, click on the "Share" icon

![]()

Then click on "Add to Home"

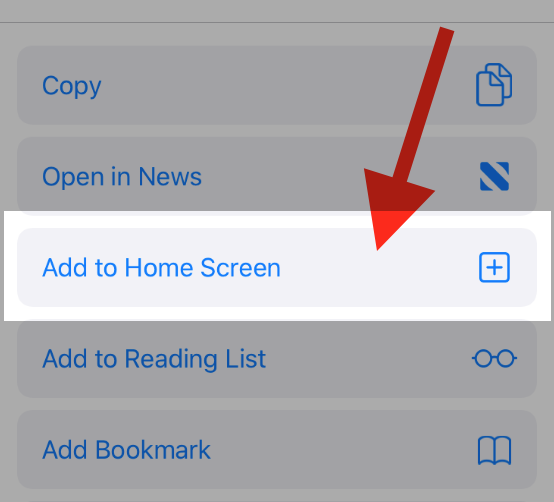

To add this web app to your homescreen, click on the "Share" icon

![]()

Then click on "Add to Home"

It looks like your browser doesn't natively support "Add To Homescreen", or you have disabled it (or maybe you have already added this web app to your applications?)

In any case, please check your browser options and information, thanks!

It looks like your browser doesn't natively support "Add To Homescreen", or you have disabled it (or maybe you have already added this web app to your applications?)

In any case, please check your browser options and information, thanks!