Four Seasons Ocean Club Residences Bahamas

Investment Thesis: This development combines Four Seasons' hospitality excellence with Paradise Island's proven appreciation trends, creating an asset class that delivers both lifestyle benefits and superior financial returns in a zero-tax environment.

The Four Seasons Ocean Club Residences represent a singular opportunity in Caribbean luxury real estate. This development will present 67 turnkey Private Residences managed by Four Seasons, positioned within Paradise Island's most exclusive oceanfront enclave. For sophisticated investors seeking both lifestyle enhancement and portfolio diversification, few opportunities match this legendary address.

With the Bahamas luxury market experiencing 18% growth in premium property transactions above $3M, and starting prices of $6.5 million for these exclusive residences, early positioning offers compelling advantages for long-term value creation.

Table of Contents

Investment Rationale and Market Position Location Analysis: Paradise Island Advantage Property Portfolio Overview The Four Seasons Management Advantage Financial Performance and Returns Acquisition Process and Requirements Frequently Asked Questions Professional Advisory ServicesInvestment Rationale and Market Position

Paradise Island: A Finite and Irreplaceable Asset

Paradise Island encompasses approximately 685 acres, with roughly 80% already developed or permanently protected. The Four Seasons Ocean Club Residences occupy prime oceanfront positioning at the island's eastern terminus, providing ocean views in multiple directions while maintaining proximity to Nassau's business infrastructure.

This geographic constraint creates natural appreciation pressure. Unlike mainland developments where additional phases can dilute exclusivity, Paradise Island's development envelope is permanently limited, ensuring scarcity value for existing properties.

Competitive Market Analysis

The Four Seasons Ocean Club Residences are strategically positioned within the Caribbean luxury residential market:

| Development | Price Range/sq ft | Management Model | Tax Environment | Accessibility |

|---|---|---|---|---|

| Four Seasons Ocean Club | $2,100-$3,200 | Four Seasons Global | Zero Tax | 15 min to Nassau Airport |

| Lyford Cay Estates | $1,200-$2,500 | Private Management | Zero Tax | 25 min to Nassau Airport |

| One&Only Residences | $2,500-$3,500 | Hotel Integration | Zero Tax | 12 min to Nassau Airport |

| St. Thomas Luxury | $1,800-$3,000 | Independent | US Tax Jurisdiction | 45 min connections |

| Barbados Platinum | $1,500-$2,800 | Independent | Income/Capital Gains Tax | Direct International |

The Four Seasons offering provides superior operational management while maintaining competitive pricing within the ultra-luxury segment, enhanced by Bahamas' favorable tax structure.

The Four Seasons Brand Premium

Four Seasons-managed residential properties demonstrate measurable performance advantages:

- Rental Rate Premiums: 25-35% above comparable non-branded properties

- Occupancy Optimization: 15-20 percentage points higher through global reservation systems

- Resale Value Protection: 12-18% premium maintenance through brand recognition and operational excellence

These advantages compound over ownership periods, creating significant value differentiation versus independent luxury properties.

Paradise Island Infrastructure Advantages

The Paradise Island location provides unique operational benefits:

- Nassau Business District: 8-minute bridge connection to financial and professional services

- International Airport: 15-minute transfer to Lynden Pindling International Airport

- Regional Connectivity: 35-minute flight to Miami with 150+ weekly departures

- Resort Integration: Immediate access to Atlantis and Ocean Club resort amenities

This accessibility profile supports both personal usage and rental market appeal, distinguishing Paradise Island from more remote Caribbean luxury developments.

Location Analysis: Paradise Island Advantage

Geographic and Climatic Benefits

Paradise Island's position creates measurable environmental advantages. The island's elevation and trade wind exposure result in temperatures 2-3 degrees cooler than Nassau proper year-round. During hurricane season, the eastern location and elevation provide enhanced protection compared to lower-lying Caribbean destinations.

Historical hurricane impact data demonstrates Paradise Island properties experience less structural damage and faster recovery periods, translating to lower insurance costs and reduced operational disruption.

Ocean Club Estates Community Integration

The Four Seasons Residences integrate within the established Ocean Club Estates community, providing access to mature infrastructure and amenities:

- Tom Weiskopf Championship Golf Course: 18-hole par-72 course hosting LPGA tournaments and international events

- Private Marina Facilities: 52-slip marina accommodating vessels to 150 feet with full-service marine support

- Exclusive Beach Club: Private Paradise Beach access with dining, tennis, and recreational facilities

- 24-Hour Security: Comprehensive security protocols and controlled access

This established amenity base reduces common risks associated with new luxury developments while providing immediate lifestyle benefits.

Resort Amenity Integration

Residence ownership includes comprehensive access to The Ocean Club resort facilities:

- Historic Versailles Gardens: 12th-century Augustinian cloister and formal gardens

- DUNE Restaurant: Michelin-starred dining by Jean-Georges Vongerichten

- Spa and Wellness: Eight Balinese-style treatment villas and fitness facilities

- Tennis and Recreation: Six Har-Tru courts and comprehensive recreational programming

Additionally, ownership provides Atlantis Resort privileges including:

- Aquaventure water park access

- 40+ dining venues from casual to fine dining

- Casino and entertainment facilities

- Marine experiences and educational programs

Nassau Professional Services Access

Paradise Island's bridge connection provides immediate access to Nassau's established professional infrastructure:

- International Banking: Royal Bank of Canada, Scotiabank Caribbean, private banking services

- Legal Services: Graham Thompson, Lennox Paton, McKinney Bancroft specialized real estate practices

- Professional Services: KPMG, PwC, Deloitte Caribbean offices for accounting and advisory services

- Medical Facilities: Doctor's Hospital Nassau, Lyford Cay Hospital for comprehensive healthcare

This professional ecosystem supports both personal residence needs and investment management requirements.

Property Portfolio Overview

Development Specifications and Architecture

The 67 residences, designed by 10SB (formerly SB Architects) with interiors by Champalimaud Design, range from 3,124 to 7,459 square feet of interior space. All residences feature floor-to-ceiling windows, expansive terraces, and panoramic ocean views, delivered fully furnished to Four Seasons hospitality standards.

The architectural design incorporates traditional Bahamian elements including whitewash walls, stately columns, and deep terraces, while introducing contemporary luxury finishes and smart home technology integration.

- Interior Square Footage: 3,124-4,200 sq ft

- Total Space with Terraces: 4,500+ sq ft

- Bedroom Configurations: 2-3 bedrooms with flexible den space

- Views: Golf course primary with ocean vistas

Investment Analysis: Garden residences offer optimal rental market positioning due to size efficiency and broad market appeal. Two-to-three bedroom luxury accommodations represent the highest-demand segment in Caribbean vacation rental markets.

- Interior Square Footage: 4,500-6,000 sq ft

- Total Space with Terraces: 6,500+ sq ft

- Bedroom Configurations: 3-4 bedrooms plus office/den

- Marina Integration: Dedicated boat slip purchase options (40-60 feet)

Lifestyle Integration: Marina residences provide direct water access through private walkways, supporting integrated boating lifestyles. Dedicated yacht slips (available separately at $250K-$500K) offer secure docking with full-service marine support.

- Interior Square Footage: 6,000-7,459 sq ft

- Total Space with Terraces: 8,500+ sq ft

- Bedroom Configurations: 4-5 bedrooms with en-suite bathrooms

- Private Amenities: Infinity-edge pools, 270-degree ocean views

Investment Positioning: Penthouse residences establish value ceiling for the entire development while providing maximum rental income potential. Peak season rates of $12,000-$15,000 per night reflect ultra-luxury market positioning.

Turnkey Furnishing and Design Package

All residences include comprehensive furnishing packages designed by Champalimaud Design, valued at $500,000-$1.2 million depending on residence size. Furnishings utilize commercial-grade materials and hotel-standard durability specifications, optimizing rental property performance while maintaining luxury aesthetics.

The turnkey delivery model eliminates typical luxury residence preparation timelines and ensures immediate rental market readiness upon closing.

The Four Seasons Management Advantage

Operational Excellence and Service Standards

Four Seasons residential management extends hospitality industry standards to private residence operations. A dedicated Director of Residences oversees all homeowner services, supported by 24/7 concierge teams, hotel-standard housekeeping, and comprehensive maintenance protocols.

This operational model addresses common luxury vacation rental challenges: inconsistent service quality, maintenance coordination, and guest experience management. Four Seasons' global operating procedures ensure consistent excellence regardless of ownership presence.

Global Reservation and Marketing Platform

Four Seasons' global reservation system provides access to approximately 50 million annual website visitors and established relationships with luxury travel advisors worldwide. This marketing reach generates booking demand unavailable to independent luxury rental properties.

The reservation integration includes:

- Direct Four Seasons website booking capability

- Global luxury travel advisor network access

- Corporate retreat and incentive travel programs

- Repeat guest loyalty program integration

Revenue Optimization Through Brand Recognition

Four Seasons brand recognition enables premium pricing in vacation rental markets. Travelers booking ultra-luxury accommodations prioritize service guarantees and brand reliability, supporting rate premiums of 25-35% above comparable non-branded properties.

This pricing advantage compounds through higher occupancy rates, as Four Seasons properties consistently achieve 15-20 percentage points higher annual occupancy through superior marketing reach and guest service reputation.

Property Maintenance and Asset Protection

Four Seasons maintenance protocols follow hospitality industry standards, including:

- Preventive maintenance schedules for all mechanical systems

- Hotel-standard cleaning between guest stays

- Regular property inspections and condition reporting

- Emergency response capabilities and vendor relationships

These protocols protect asset value through consistent upkeep while ensuring rental properties maintain Four Seasons quality standards throughout ownership periods.

Financial Performance and Returns

Market Performance Data and Projections

The Bahamas luxury rental market demonstrates strong fundamentals with measurable growth trends:

2024 Market Performance:

- Monthly luxury rental rates increased 15.2% year-over-year

- Average luxury property rates at $1,161 monthly (44% above Caribbean average)

- Peak season premiums of 200-300% above base rates

- American visitor dominance at 90% of tourist arrivals supporting USD-based demand

Rental Income Projections by Property Type

Tax Optimization Benefits

The Bahamas provides comprehensive tax advantages for international property investors:

Zero Tax Environment:

- No personal income tax on rental income

- No capital gains tax on property appreciation

- No inheritance tax on wealth transfer

- No annual property taxes

All Four Seasons Ocean Club residences exceed the $1M minimum investment threshold for Economic Permanent Residency, providing unlimited Bahamas residency privileges and enhanced tax planning opportunities.

Comparative Tax Impact Analysis: For US-based investors, comparable rental income would incur 35-40% federal and state tax obligations. On $670,500 annual net income, this represents $268,200 in annual tax savings, totaling $2.68 million over a 10-year ownership period.

Portfolio Diversification and Wealth Preservation

Bahamas real estate provides portfolio diversification benefits through:

- Currency Stability: BSD pegged 1:1 to USD eliminating exchange rate risk

- Political Stability: 50+ years of democratic governance and property rights protection

- Inflation Hedge: Tangible asset appreciation potential during inflationary periods

- Geographic Diversification: Caribbean exposure with North American accessibility

Acquisition Process and Requirements

Government Approval Process for Non-Bahamian Buyers

Foreign property acquisition in the Bahamas requires Bahamas Investment Authority (BIA) approval through a comprehensive application process:

Required Documentation:

- Comprehensive financial statements and proof of funds

- Character references and background verification

- Detailed property purchase documentation

- Source of funds certification for anti-money laundering compliance

- Intended use declaration and ownership structure

Processing Timeline:

- Standard processing: 8-12 weeks for complete applications

- Expedited processing: 4-6 weeks for qualifying purchases above $5M

- Application review may require additional documentation or clarification

Legal Framework and Closing Procedures

The acquisition process follows established protocols with specific compliance requirements:

Phase 1: Property Reservation (Weeks 1-4)

- Financial pre-qualification and property selection

- Reservation agreement execution with deposit ($500K-$1M)

- Professional team assembly (legal, banking, advisory)

Phase 2: Due Diligence and Approval (Weeks 5-12)

- BIA application submission and processing

- Legal due diligence including title verification and development approvals

- International banking coordination and financing arrangements

Phase 3: Contract Execution and Closing (Weeks 13-16)

- Purchase agreement finalization and execution

- Final property inspections and acceptance procedures

- Funds transfer coordination and title registration

- Closing completion and key transfer

Acquisition Cost Structure

International Banking and Financing

Banking Requirements:

- International banking relationships for large wire transfers

- Anti-money laundering documentation and compliance

- Multi-jurisdictional account coordination for transaction management

Financing Options: Bahamian banks including Royal Bank of Canada and Scotiabank Caribbean offer international mortgage products for qualified buyers, typically providing 70% loan-to-value ratios with competitive interest rates for prime borrowers.

Request Exclusive Property Information

Get personalized investment analysis and priority access to Four Seasons Ocean Club Residences

Your information is secure and will only be used for Four Seasons property updates

Frequently Asked Questions

Professional Advisory Services

Comprehensive Investment Advisory

Professional guidance is essential for optimizing Four Seasons Ocean Club investments. Experienced advisors provide:

Market Analysis and Property Selection:

- Comparative market evaluation and competitive positioning

- Property-specific investment analysis and return projections

- Optimal timing strategies based on market conditions and inventory availability

Due Diligence and Risk Assessment:

- Legal and financial due diligence coordination

- Development progress monitoring and quality assurance

- Investment structure optimization for tax and estate planning benefits

Government Relations and Process Management

BIA Approval Management:

- Application preparation and submission coordination

- Government liaison and approval process acceleration

- Documentation requirements and compliance assurance

Legal Coordination:

- Bahamian legal counsel selection and management

- Purchase agreement negotiation and contract optimization

- Closing coordination and transaction oversight

Ongoing Investment Management

Property Performance Optimization:

- Four Seasons management oversight and quality assurance

- Rental income optimization and market positioning strategies

- Property maintenance and capital improvement planning

Portfolio Integration:

- Multi-property acquisition coordination for portfolio buyers

- Estate planning integration and wealth preservation strategies

- Market updates and future opportunity identification

Investment Conclusion and Next Steps

The Four Seasons Ocean Club Residences represent a convergence of location scarcity, brand excellence, and financial optimization within the Caribbean's most favorable investment environment. With only 67 residences available and the Bahamas maintaining its position as the fastest-growing luxury real estate market globally, this opportunity offers compelling advantages for sophisticated investors.

Key Investment Advantages:

- Limited Supply: Finite development within Paradise Island's restricted development envelope

- Operational Excellence: Four Seasons global management platform and service standards

- Tax Optimization: Zero income, capital gains, and inheritance taxes in stable jurisdiction

- Rental Performance: Superior yields through Four Seasons reservation system and brand recognition

- Appreciation Potential: Historical Paradise Island performance and future scarcity value

Immediate Action Requirements:

- Property Tour Coordination: Schedule comprehensive site visit and comparable property evaluation

- Financial Analysis: Complete investment modeling based on specific acquisition objectives

- Government Approval Initiation: Begin BIA application process for qualified international buyers

- Professional Team Assembly: Coordinate legal, banking, and advisory relationships

About the Author

Glenn Ferguson is a premier luxury real estate investment specialist with over 15 years of exclusive focus on Paradise Island and Nassau's ultra-high-end property market. As an authorized Four Seasons representative and certified international property advisor, Glenn has facilitated over $500 million in luxury real estate transactions throughout the Bahamas.

Glenn's expertise encompasses the complete luxury property acquisition process, from initial market analysis through government approvals, legal coordination, and long-term investment management. His deep understanding of Bahamas Investment Authority requirements and established relationships with government officials, legal professionals, and international banking partners ensure seamless transactions for discerning international buyers.

Professional Credentials & Experience:

- Licensed Bahamas Real Estate Agent - Bahamas Real Estate Association

- Four Seasons Authorized Representative - Ocean Club Residences & Private Estates

- 24+ Years Paradise Island Expertise - Exclusive focus on ultra-luxury segment

- Transaction Volume - Proven track record with international clientele

- Government Relations Specialist - BIA approval process optimization

Glenn's ideal clients include Fortune 500 executives, international entrepreneurs, professional athletes, and entertainment industry leaders seeking strategic Caribbean real estate investments. His comprehensive approach integrates market analysis, tax optimization strategies, and wealth preservation planning to maximize both lifestyle benefits and financial returns.

Based permanently in Nassau with offices on Cable Beach, Glenn provides personalized, white-glove service throughout the entire acquisition process and ongoing ownership experience. His commitment to excellence and deep local expertise make him the preferred advisor for Four Seasons Ocean Club Residences and other premier Paradise Island luxury properties.

Contact Information for Professional Advisory Services

Luxury Real Estate Investment Specialist

Paradise Island & Nassau Expertise

Four Seasons Authorized Representative

Licensed Bahamas Real Estate Agent

Office: Cable Beach, Suite 500

Consultation: Available by appointment - Nassau, Miami, or via secure video conference

Service Specializations:

- Four Seasons Ocean Club Residences acquisition and advisory

- Paradise Island luxury real estate investment analysis

- Bahamas government approval and legal process coordination

- International buyer representation and advocacy

- Portfolio diversification and wealth preservation strategies

- Economic Permanent Residency application assistance

- Luxury property management and rental optimization

- Estate planning integration for international property holdings

Why Choose Glenn Ferguson:

- Exclusive Market Access: Direct relationships with Four Seasons development team and priority property allocations

- Government Relations: Established BIA connections for expedited approval processing

- International Expertise: Extensive experience with US, Canadian, European, and Latin American buyers

- Comprehensive Service: Full-service approach from initial consultation through ongoing ownership support

- Local Presence: Nassau-based with immediate availability for property tours and market updates

The Four Seasons Ocean Club Residences: Where hospitality excellence meets investment opportunity in paradise. Professional guidance ensures optimal acquisition and long-term value realization.

"Delivering exceptional results through deep market knowledge, professional excellence, and unwavering commitment to client success."

- Glenn Ferguson, Luxury Real Estate Investment Specialist

Disclaimer

This analysis is provided for informational purposes and does not constitute investment advice. Prospective buyers should conduct independent due diligence and consult qualified professionals before making investment decisions. All financial projections are estimates based on historical market performance and current conditions, which may vary in future periods.

Explore More Bahamas Luxury Real Estate

Other Luxury Developments

Investment Resources

Market Insights

Ready to Explore Four Seasons Ocean Club Residences?

Contact Glenn Ferguson for exclusive property tours and personalized investment analysis

Call (242) 395-8495Heading

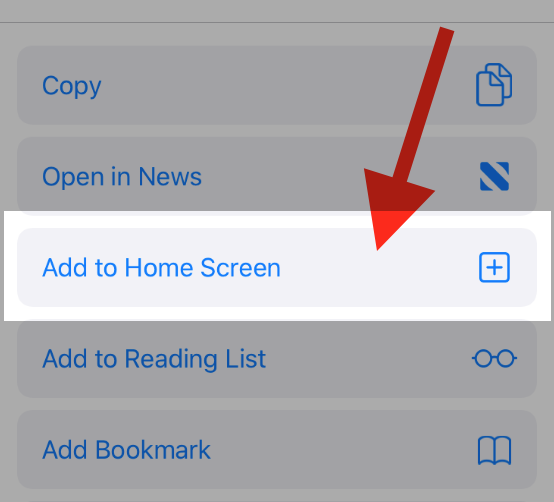

To add this web app to your homescreen, click on the "Share" icon

![]()

Then click on "Add to Home"

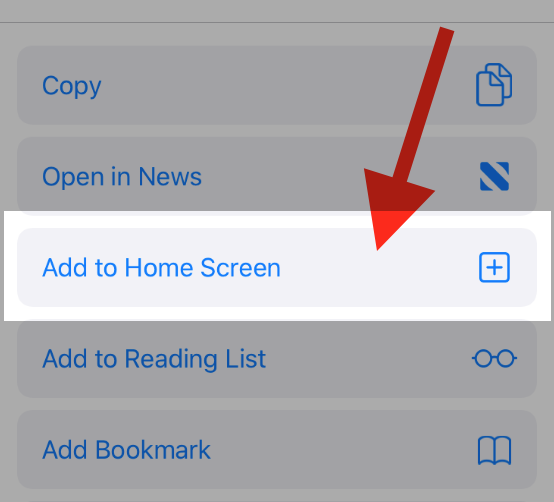

To add this web app to your homescreen, click on the "Share" icon

![]()

Then click on "Add to Home"

It looks like your browser doesn't natively support "Add To Homescreen", or you have disabled it (or maybe you have already added this web app to your applications?)

In any case, please check your browser options and information, thanks!

It looks like your browser doesn't natively support "Add To Homescreen", or you have disabled it (or maybe you have already added this web app to your applications?)

In any case, please check your browser options and information, thanks!