Guide to Buying Property in The Bahamas

Everything you need to buy property in The Bahamas — ownership rights, the step-by-step process, closing costs, taxes, best islands, financing, residency, and rental income. The Bahamas offers foreign buyers full freehold ownership, zero income tax, zero capital gains tax, and a clear path to permanent residency.

BREA Licensed #1247 ·

24+ Years Experience ·

EPR Residency Consultant ·

All Islands Coverage

BREA Licensed #1247 ·

24+ Years Experience ·

EPR Residency Consultant ·

All Islands Coverage

Why Buy Property in The Bahamas?

The Bahamas combines the most foreign-buyer-friendly ownership laws in the Caribbean with zero income tax, zero capital gains tax, zero inheritance tax, a currency pegged 1:1 to the US dollar, and a clear residency pathway through real estate investment.

Tax-Free Environment

No income tax, no capital gains tax, no inheritance tax, no wealth tax. Rental income from Bahamas property is not taxed by the Bahamian government. One of the world's most favourable tax jurisdictions for property investors.

Full Freehold Ownership

Foreign buyers receive the same ownership rights as Bahamian citizens — full freehold title, no expiration, no leasehold, no restrictions on owner-occupied residential purchases.

USD Currency Peg

The Bahamian dollar (BSD) is pegged 1:1 to the US dollar by the Central Bank of The Bahamas since 1973. Both currencies accepted everywhere. No foreign exchange risk for American buyers.

Residency Pathway

Invest $1,000,000+ in residential real estate and qualify for Economic Permanent Residency (EPR). Live and bank in The Bahamas. Family included. No requirement to renounce existing citizenship.

Record Tourism Economy

12.5 million visitors in 2024. $7 billion in tourism revenue. Strong year-round rental demand. Branded residences at Baha Mar, Rosewood, and Four Seasons drive premium nightly rates.

Proximity to the US

Nassau is 187 miles from Miami — a 45-minute flight. Direct flights from 20+ US cities. Grand Bahama is just 55 miles from Florida's coast. BA253 daily direct from London Heathrow (9 hours).

Most buyers come for the lifestyle and discover the investment case. No income tax, no capital gains, strong rental yields, and currency stability — The Bahamas checks every box for both personal use and wealth building. I have guided hundreds of international buyers through the process over 24 years, and the fundamentals have never been stronger than they are now in 2026.

Foreign ownership rights

Foreign ownership rights

What Rights Do Foreign Buyers Have in The Bahamas?

Foreign nationals enjoy the same property ownership rights as Bahamian citizens. The Bahamas operates under English common law — the same legal framework used in the UK, Canada, and Australia. You receive full freehold title: you own the property and the land outright, with no expiration and no lease. The Judicial Committee of the Privy Council in London remains the final court of appeal.

When is a permit NOT required?

For owner-occupied residential properties, no government permit is required under the International Persons Landholding Act, 1993. Your purchase is registered with the Investments Board for record-keeping only — it does not restrict or delay anything. Your attorney handles this at closing.

When IS a permit required?

A Bahamas Investments Board permit is required for: undeveloped land where the non-Bahamian would become the holder of 2 or more contiguous acres (per the BIA's practical application and the Legal 500 Bahamas Real Estate Guide 2025), property not intended as owner-occupied (purchased solely as a rental or commercial investment), or commercial property. Note: The original IPLA 1993 statute text refers to "five or more contiguous acres" for single-family dwelling purchases, and BREA's legislation page cites 5 acres. In practice, the Investments Board commonly applies a 2-acre threshold for undeveloped land. Glenn advises buyers to confirm the applicable threshold with their Bahamian attorney for each specific transaction.

Permits issued since July 2024 expire if the buyer fails to pay the applicable VAT and submit change-of-ownership notice to the Department of Inland Revenue within 180 days. Since July 2025, permits can be extended for a further 180 days by application.

What can you do with your property?

Sell it freely, rent it (long-term or short-term, subject to HOA rules and Hotel Licensing for stays under 45 days), renovate it, pass it to heirs (no inheritance tax, no forced heirship rules), or use it to qualify for Economic Permanent Residency if the investment meets the $1M threshold.

Home Owner's Residence Card

All foreign property owners should obtain a Home Owner's Residence Card from the Department of Immigration. This card facilitates your entry and exit into The Bahamas as a property owner (separate from EPR or tourist visa). It is renewable upon proof of ownership. Glenn coordinates the application as part of the purchase process.

Confusing The Bahamas with Caribbean nations that restrict foreign ownership to leasehold (e.g., some Crown Land areas in Barbados, BVI restrictions). The Bahamas offers full freehold — one of the most foreign-buyer-friendly jurisdictions in the world. Note: the IPLA 1993 statute cites 5 contiguous acres for single-family dwellings, but the BIA commonly applies a 2-acre threshold for undeveloped land. Always confirm with your attorney.

Property types

Property types

What Types of Property Can You Buy in The Bahamas?

Foreigners can buy condominiums, single-family homes, townhouses, vacant land, commercial property, and private islands. Condominiums are the most popular entry point. Luxury gated communities represent the premium market. Each property type has distinct considerations around HOA rules, rental restrictions, and investment potential.

Condominiums

Most popular entry point. Branded residences at Goldwynn, One Cable Beach, and Baha Mar. Many allow short-term rentals. HOA fees include building insurance, common areas, and amenities. Entry from ~$300K to $15M+.

Single-Family Homes

Gated communities: Ocean Club Estates, Lyford Cay, Albany, Old Fort Bay, Palm Cay. Private pools, beachfront, marina access. The luxury segment. $1M to $40M+.

Townhouses

Lower maintenance than single-family, more space than condos. Increasingly available in new Nassau developments. Good balance of lifestyle and investment. $500K to $1.5M.

Vacant Land

Build your custom home with a local licensed architect. Agent commission is 10% on vacant land (vs. 6% improved). Investments Board permit needed for 2+ contiguous acres undeveloped (BIA practice). Beachfront lots are scarce.

Commercial Property

Retail, office, hotel, and mixed-use. Requires Investments Board approval for foreign buyers. 6% commission on commercial buildings, 10% on commercial businesses. Separate due diligence process.

Private Islands

The Bahamas has more private islands for sale than any Caribbean nation. Exuma chain is the most popular. Requires infrastructure planning, government approvals, and specialised knowledge. $1M to $120M+.

Before you fall in love with a property, I review the HOA documents for rental restrictions. Buildings with short-term rental rights can be worth 20-40% more than identical units in buildings that restrict them. This is the single most overlooked factor in Bahamas buying. I also check for any outstanding special assessments or upcoming capital expenditure levies that could surprise you post-closing.

How to Buy Property in The Bahamas — Step by Step

The typical purchase takes 60-90 days from accepted offer to closing. Cash purchases can close faster (45-60 days). Mortgage-backed purchases may add 30-60 days. Since the Conveyancing and Law of Property (Amendment) Act 2025 (effective 1 July 2025), a VAT invoice must be obtained from the Department of Inland Revenue before executing the conveyance. Glenn manages every step from first enquiry through key handover and residency filing.

Engage a BREA-Licensed Agent

Hire a licensed agent with active Bahamas MLS membership. Glenn Ferguson (BREA #1247) provides full MLS access, off-market inventory, comparable closed sale data, and residency filing — all under one roof. The seller pays the agent's commission, so using a buyer's agent costs you nothing.

Define Your Criteria & Budget

Specify your preferred island, property type, budget range, and primary goal — personal use, rental income, residency qualification, or a combination. Glenn curates a matched shortlist including off-market properties not available on portals.

Tour Properties & Analyse

Visit shortlisted properties in person or via video tour. Glenn provides comparable closed sale prices, $/sqft analysis, HOA document review (including rental restrictions and special assessments), and property-specific rental projections.

Make an Offer

Submit a written offer with a 10% deposit held in escrow by the seller's attorney. Glenn negotiates price and terms using closed sale data and market intelligence. The deposit is refundable if the transaction falls through for reasons specified in the agreement.

Hire a Bahamian Attorney

Your attorney conducts a title search (confirming clear ownership back 30+ years), prepares conveyance documents, and manages the legal closing. The attorney's opinion on title functions like title insurance under Bahamas law — the attorney is personally liable for title defects. Legal fees: 2.5%-3.5% of purchase price (Bahamas Bar Association raised the minimum to 3.5% for registered land in January 2026). Glenn recommends trusted attorneys.

Complete Registrations & VAT Invoice

Register under the International Persons Landholding Act 1993 (standard for all foreign owner-occupied residential purchases — record-keeping only). Since July 2025, your attorney must obtain a VAT invoice from the Department of Inland Revenue before executing the conveyance. All VAT must be paid within 180 days of execution. Investments Board permit required for undeveloped land of 2+ acres, non-owner-occupied, or commercial property.

Close, Transfer Title & File for Residency

Pay VAT on conveyance (10% for foreign purchases — split negotiable between buyer and seller), legal fees, and the remaining purchase balance. Title transfers to your name as freehold owner. Register with Exchange Control at the Central Bank. For purchases of $1,000,000+, Glenn files your Economic Permanent Residency (EPR) application — no separate immigration firm needed.

I give every buyer a detailed closing cost estimate and timeline before they make an offer. No surprises. I also negotiate VAT on conveyance splits — not every deal has to be 50/50. On a $2M property, negotiating a 60/40 split saves the buyer $20,000. Since the July 2025 amendment requiring a VAT invoice before execution, timing your closing correctly is more important than ever.

Glenn Ferguson · BREA #1247 · Bahamas MLS · 24+ Years

Glenn Ferguson · BREA #1247 · Bahamas MLS · 24+ Years

What Does It Cost to Buy Property in The Bahamas?

Total buyer-side closing costs are approximately 10-14% of the purchase price for foreign buyers. The VAT on conveyance (10% for non-Bahamian purchases over $100,000) is the single largest cost. Since the VAT (Amendment) Act 2022, real estate transfers are subject to VAT on conveyance — the correct current terminology for property transfer tax in The Bahamas.

| Cost Item | Amount | Notes |

|---|---|---|

| VAT on Conveyance | 10% | Foreign buyer rate on purchases over $100,000. Split between buyer and seller is negotiable (commonly 50/50, but Glenn negotiates better splits) |

| Attorney Fees | 2.5%-3.5% | Title search, conveyance, closing management. Bar Association raised minimum to 3.5% for registered land (January 2026) |

| VAT on Professional Services | 10% of fees | Applied to legal fees and agent commissions |

| Title Insurance (optional) | 0.5%-1% | Available through Bahamas-based insurers; recommended for foreign buyers |

| EPR Government Fee (if applicable) | $20,000 / $25,000 | Standard / with work rights. Plus $100 processing fee and $300/dependant |

| Agent Commission | $0 (buyer pays nothing) | Seller pays 6% + VAT (improved) or 10% + VAT (vacant land) |

Example — $1.5M home purchase (50/50 VAT split): VAT on conveyance (buyer's 5%): $75,000. Attorney fees (~2.5%): $37,500. VAT on services: ~$3,750. Title insurance (~0.75%): ~$11,250. Total buyer costs: ~$127,500 (approximately 8.5%). If buyer pays full 10% VAT: total rises to approximately 13.5%.

Sources: Bahamas Department of Inland Revenue (VAT rates), Bahamas Bar Association (January 2026 fee schedule), DuPuch Real Estate (closing cost guide), Legal 500 Bahamas Real Estate Guide (March 2025).

Budgeting 2-3% for closing because a blog only mentioned "legal fees." The VAT on conveyance is the largest cost and surprises most first-time Bahamas buyers. For foreign buyers, the total VAT is 10% (not the graduated Bahamian citizen rate). Always get a detailed cost estimate from Glenn before making an offer.

What Taxes Do Property Owners Pay in The Bahamas?

The Bahamas has zero income tax, zero capital gains tax, zero inheritance tax, and zero wealth tax. Rental income is not taxed by the Bahamian government. The only ongoing tax is annual real property tax, which is tiered by property value and capped.

Annual Real Property Tax (Owner-Occupied)

| Assessed Value Band | Rate |

|---|---|

| First $300,000 | Exempt (0%) |

| $300,000 – $500,000 | 0.625% |

| Above $500,000 | 1.0% |

| Maximum annual tax | $150,000 cap (since July 2023) |

Owner-occupied qualification: You must reside in the property for 6+ months per year to qualify for owner-occupied rates. Pay by 31 March each year to receive a 10% early-payment discount. Tax is due by 31 December; a 5% surcharge applies from 1 January on unpaid balances.

Non-Owner-Occupied & Commercial Rates

| Assessed Value Band | Rate |

|---|---|

| Up to $500,000 | 0.75% |

| $500,000 – $2,000,000 | 1.0% |

| Above $2,000,000 | 1.5% |

Freeport, Grand Bahama: Properties within the Freeport Licenced Area are exempt from real property tax under the Hawksbill Creek Agreement. This is one of the reasons Grand Bahama offers the lowest total ownership costs in The Bahamas.

Family Islands: Bahamian citizens on the Family Islands (Out Islands) do not currently pay property tax. However, foreign owners on the Family Islands are required to pay.

VAT on services: A 10% Value Added Tax applies to real estate professional services including agent commissions, legal fees, and appraisal fees. This is a transaction cost, not an ongoing annual tax.

Important for US citizens: The United States taxes citizens on worldwide income regardless of residency. Bahamas EPR does not exempt US citizens from IRS obligations including FBAR, FATCA, and Schedule E rental reporting. Glenn connects EPR clients with international tax advisers who specialise in cross-border structures. See the American Investors Guide for full IRS details.

Important for UK citizens: The UK non-dom regime was abolished 6 April 2025. IHT long-term resident test with a 3-10 year tail applies. See the British Investors Guide for full HMRC details.

Sources: Bahamas Department of Inland Revenue (Real Property Tax Act), Real Property Tax (Amendment) Act 2022 & 2023, Tribune242.com (June 2023 — cap increase to $150K), Central Bank of The Bahamas, Alexiou Knowles & Co. (December 2024), DuPuch Real Estate (closing cost guide).

The Bahamas' total cost structure — 10% VAT at purchase plus minimal annual property tax — is the most favourable in the Caribbean. Compare: Turks & Caicos charges 12.5% transfer tax. BVI charges 12%. Bermuda charges over 25% for high-value properties. And none of those offer a residency pathway through property investment.

Caribbean Tax Comparison

| Jurisdiction | Transfer Tax | Income Tax | CGT | Annual Property Tax | Residency via Property |

|---|---|---|---|---|---|

| The Bahamas | 10% VAT (split negotiable) | 0% | 0% | 0-1% (capped $150K) | Yes — $1M EPR |

| Turks & Caicos | 12.5% | 0% | 0% | None | No EPR equivalent |

| Cayman Islands | 7.5% | 0% | 0% | None | $2.4M investment |

| BVI | 12% | 0% | 0% | Varies | Limited |

| Bermuda | Up to 25%+ | 0% | 0% | ARV-based | Restricted |

| Barbados | 2.5% + 1% stamp | Up to 28.5% | 0% | 0.1-0.75% | SSRL visa |

Rates as of 2025. Subject to change. Consult a licensed tax adviser for jurisdiction-specific advice.

Best islands & areas

Best islands & areas

Where Should You Buy Property in The Bahamas?

Nassau and Paradise Island account for approximately 70% of all transactions and offer the deepest inventory and strongest resale liquidity. The Family Islands deliver higher nightly rental rates and faster appreciation. Glenn works across every island and advises based on your specific goals — rental yield, privacy, appreciation, or lifestyle.

Nassau & Paradise Island — Most Liquid

Ocean Club Estates, Lyford Cay, Albany, Old Fort Bay, Palm Cay, Cable Beach. The deepest market with strongest resale liquidity. ~70% of transactions. Entry from ~$300K (condos) to $40M+ (estates).

Cable Beach & Baha Mar — Best Yields

Goldwynn, One Cable Beach, Rosewood Residences. Newest construction. Walking distance to the $4.2B Baha Mar resort. Branded residences drive premium rental returns. $700K–$15M+.

Exuma — Highest Rates

Crystal waters, celebrity buyers, private islands. Limited inventory creates scarcity pricing and premium nightly rates (~$750/night). The Swimming Pigs and Thunderball Grotto drive year-round tourism.

Eleuthera & Harbour Island — Fastest Growth

Pink sand beaches, boutique luxury. Strong tourism growth. Privacy-focused international buyers. Harbour Island commands among the highest $/sqft prices in The Bahamas. $450–$800/night.

Abaco — Recovery Play

Post-Dorian recovery. Record visitors in 2025. Baker's Bay, Treasure Cay, Hope Town, Elbow Cay. Prices rising from post-hurricane lows with significant upside potential.

Grand Bahama — Value Entry

Just 55 miles from Florida. Record visitors in 2025 (first time in 22 years). Lowest luxury entry prices in The Bahamas. Port Lucaya, Fortune Bay, and beachfront communities.

Can Foreigners Get a Mortgage in The Bahamas?

Yes. Bahamian banks offer mortgages to foreign buyers — but terms are stricter than in the US or Europe. Most foreign buyers purchase with cash, but financing is available for those who need it.

Banks that lend to foreign buyers: RBC Royal Bank (Bahamas), CIBC FirstCaribbean International Bank, and Scotiabank (Bahamas). Each has different requirements and rates. Glenn connects buyers with lending officers at all three.

Cash vs. mortgage: Cash purchases close faster (45-60 days vs. 90-120 days with financing), have stronger negotiating power, and avoid Bahamian interest rates that are higher than US rates. If you're financing through a US bank against existing assets, that's often a better structure than a Bahamian mortgage.

Exchange Control registration: Foreign buyers should register their investment with the Exchange Control Department of the Central Bank of The Bahamas at the time of purchase. This ensures you can repatriate the entire proceeds including any capital appreciation when you sell. Your attorney handles this registration.

Residency through real estateCan Buying Property Get You Bahamas Permanent Residency?

Yes. Investing $1,000,000 or more in residential real estate qualifies you for Economic Permanent Residency (EPR). The threshold increased from $750,000 to $1,000,000 on 1 January 2025, as confirmed by the Bahamas Immigration Department and Lennox Paton's March 2025 legal advisory.

| EPR Requirement | Detail |

|---|---|

| Minimum investment | $1,000,000 in residential real estate (January 2025) |

| Government fee (standard) | $20,000 — without work rights |

| Government fee (work rights) | $25,000 — right to engage in gainful occupation in own business |

| Processing fee | $100 — non-refundable, paid at submission |

| Dependant endorsement | $300 per person — spouse + children under 18 |

| Hold period | 10 years minimum |

| Presence requirement | 90 days per year |

| Processing time | 6–18 months |

What EPR gives you: The right to reside in The Bahamas indefinitely and become a tax resident of a zero-income-tax nation. No requirement to renounce your existing citizenship. Enter and exit The Bahamas freely. Important: Standard EPR ($20,000 fee) does not include the right to work in The Bahamas. The $25,000 EPR tier grants the right to engage in gainful occupation in your own business only. Employment for others still requires a separate work permit.

Home Owner's Residence Card (HORC): All foreign property owners — regardless of investment amount — should obtain a Home Owner's Residence Card from the Department of Immigration. This card facilitates entry and re-entry as a property owner and can be renewed annually upon proof of ownership. HORC does not confer the right to work.

Accelerated consideration: Applications supported by investments of $1.5 million or more receive expedited review — the Bahamas Immigration Department has committed to processing these within 21 days.

10-year declaration: EPR holders must file a declaration every 10 years confirming that the information in the original application remains materially unchanged. If you sell the qualifying property before year 10, you must reinvest into another qualifying property or risk losing EPR status.

Gender restriction: Under current Bahamian immigration law, the EPR endorsement language refers to the "wife" of the EPR holder. Female EPR holders may face limitations endorsing a husband. Consult your Bahamian attorney on this gender-specific restriction.

Path to citizenship: After holding EPR and residing in The Bahamas for a cumulative 6 of the previous 10 years, you may apply for Bahamian citizenship by naturalisation. The decision is discretionary and made by the Minister responsible for Immigration. Bahamian citizenship provides a Bahamas passport (visa-free access to 155+ countries) and the right to vote. There is no automatic right to citizenship — it must be applied for and approved.

For complete jurisdiction-specific guides, see: American Investors | British Investors | Canadian Investors | Indian Investors.

Sources: Bahamas Immigration Department (immigration.gov.bs), Lennox Paton Attorneys (March 2025), Legal 500 Bahamas Real Estate Guide.

Reading outdated guides citing the $750K EPR threshold. That figure expired 1 January 2025. Budgeting $750-$999K for EPR qualification means you will fall short of the current $1M minimum. Also note: the EPR government fee is $20,000 (standard) or $25,000 (with work rights) — not just "$20,000" as some guides state.

Rental income & ROI

Rental income & ROI

What Rental Income Can You Earn from Bahamas Property?

The Bahamas' record tourism (12.5M visitors in 2024, $7B revenue) drives strong year-round rental demand. Short-term vacation rentals command premium nightly rates, especially in branded residences and beachfront locations. Rental income is not taxed by the Bahamian government.

Short-term rental rates by area: Cable Beach/Baha Mar branded residences: $400–$1,200/night. Exuma: ~$750/night. Eleuthera/Harbour Island: $450–$800/night. Nassau condos: $150–$400/night. These are peak-season ranges — Glenn provides property-specific pro-formas with seasonal occupancy adjustments.

Property management: Expect 20-30% of gross rental income for full-service management (guest coordination, cleaning, maintenance, owner reporting). Some branded residences include management programmes at negotiated rates.

HOA rental restrictions: This is the single most overlooked factor in Bahamas buying. Some buildings allow short-term vacation rentals (Airbnb/VRBO). Others restrict to long-term only (6+ months). Buildings with short-term rental rights can be worth 20-40% more than identical units with restrictions. Glenn reviews HOA documents before you make an offer.

Licensing: Short-term rental properties (stays under 45 days) are subject to 10% VAT. Owners must register with the Hotel Licensing Department of the Bahamas Ministry of Tourism. Property owners who rent out real estate are also generally required to obtain and annually renew a business licence (fees typically $250-$1,250 depending on rental income).

Annual ownership costsWhat Are the Annual Costs of Owning Bahamas Property?

| Annual Cost | Typical Range | Notes |

|---|---|---|

| Real Property Tax | 0–1% | Owner-occupied: first $300K exempt, 0.625% $300K-$500K, 1% above $500K, cap $150K/yr. Non-owner-occupied: 0.75%-1.5% |

| Homeowner's Insurance | 1.5–3% | Of insured value; includes hurricane coverage (mandatory for mortgaged properties) |

| HOA Fees | $400–$2,500+/mo | Varies by community; covers building insurance, common areas, amenities |

| Property Management | 20–30% | Of gross rental income; for vacation rental owners not managing directly |

| Maintenance | 1–2% | Of property value; salt air accelerates wear on exteriors and fixtures |

Insurance note: The Bahamas is in the hurricane belt. Insurance costs are higher than mainland US but are a non-negotiable expense. Policies typically cover wind, flood, and named storms. Glenn connects buyers with insurance brokers who specialise in island properties.

Property tax compliance: Outstanding real property tax creates a first charge (lien) on the property. If real property tax is not current, the Bahamas Investment Authority will not issue permits, the Department of Inland Revenue will not accept conveyances for VAT stamping, and building permits will not be issued. The government may sell the property to recover unpaid taxes after due process.

Purchasing through a companyCan You Buy Through a Company in The Bahamas?

Yes. Foreign buyers can purchase Bahamas real estate through a Bahamian International Business Company (IBC) or a domestic company. This is common for privacy, estate planning, and multi-investor structures. However, it changes the tax and regulatory treatment significantly.

VAT treatment: Purchases by non-Bahamian owned companies attract the flat 10% VAT on conveyance (same as individual foreign buyers). Bahamian-owned companies pay graduated rates (2.5% under $100K up to 10% above $100K). This distinction matters for structuring.

Property tax: Company-owned properties are classified as commercial/non-owner-occupied and taxed at the higher commercial rates (0.75% up to $500K, 1% $500K–$2M, 1.5% above $2M) rather than the lower owner-occupied rates.

EPR qualification: The EPR investment must be in the individual's name to qualify. Purchasing through a company does not satisfy the EPR real estate investment requirement unless the individual is the beneficial owner and this is clearly documented.

Business licence: Companies owning rental property in The Bahamas are required to obtain and annually renew a business licence. Annual fees range from $100 (turnover under $50K) to 0.50%–1.25% of turnover above that.

Most individual buyers purchasing for personal use and EPR should buy in their own name — it simplifies the process, qualifies for owner-occupied tax rates, and satisfies EPR requirements directly. Company structures are better suited for multi-property portfolios, rental-only investments, or situations where privacy and estate planning justify the additional complexity and cost.

What Happens When You Sell Your Bahamas Property?

Zero capital gains tax. The Bahamas does not tax profits on the sale of real estate. Your entire gain is retained.

Seller costs: The seller typically pays their share of the VAT on conveyance (commonly 50% of the 10%), the real estate commission (6% + VAT on improved property, 10% + VAT on vacant land), and their own legal fees (typically 1–2.5% + VAT).

Repatriating proceeds: If you registered your investment with the Exchange Control Department of the Central Bank of The Bahamas at the time of purchase, you can repatriate the entire sale proceeds — including capital appreciation — in full. This is why Exchange Control registration at closing is critical and non-negotiable.

EPR implications: If you hold Economic Permanent Residency and sell the qualifying property before the 10-year hold period expires, you must reinvest into another property meeting the $1M threshold or risk losing EPR status. Glenn advises on reinvestment timing and property selection.

Tax obligations in your home country: While The Bahamas charges zero CGT, your home country may tax the gain. US citizens owe tax on worldwide capital gains. UK residents may owe CGT depending on domicile status. Canadian residents owe tax on 50% of gains. Always consult your international tax adviser before selling.

Will & estate planningWhy You Need a Bahamian Will — Estate Planning for Property Owners

Zero inheritance tax in The Bahamas. Property passes to heirs tax-free. However, without proper estate planning, your heirs may face significant delays and costs in obtaining a grant of probate.

Why a separate Bahamian will is essential: A will executed in the US, UK, or Canada may not be automatically recognised by Bahamian courts. Your heirs would need to obtain a "resealing" of the foreign grant of probate in The Bahamas — a process that can take months and cost thousands of dollars. A Bahamian will specifically covering your Bahamas property avoids this entirely.

Joint tenancy vs. tenancy in common: If purchasing with a spouse or partner, consider how title is held. Joint tenancy includes a right of survivorship — the surviving owner automatically inherits the deceased's share without probate. Tenancy in common means each owner's share passes per their will. Glenn and your attorney advise on the best structure for your situation.

No forced heirship: Unlike civil law jurisdictions (France, most of Latin America), The Bahamas has no forced heirship rules. You can leave your property to whomever you choose.

Cost: A Bahamian will is typically drafted by your attorney alongside the conveyance for a nominal additional fee ($500–$1,500). It is one of the highest-value, lowest-cost steps in the entire purchase process.

Over 24 years, Glenn has seen foreign families spend months and thousands of dollars trying to access Bahamas property after a death because no Bahamian will existed. This is 100% avoidable. Glenn ensures every buyer's attorney prepares a Bahamian will at closing.

What Insurance Do You Need for Bahamas Property?

Hurricane coverage is non-negotiable. The Bahamas sits in the Atlantic hurricane belt. Insurance is your single most important ongoing cost after property tax.

Typical coverage: Policies cover wind, flood, named storms, and sometimes earthquake. Premiums run 1.5–3% of insured value annually. Windstorm deductibles are typically 2–5% of the insured value (not the claim amount) — meaning on a $2M property, your hurricane deductible could be $40K–$100K.

Post-Dorian reality: After Hurricane Dorian (2019, Category 5), some areas of Abaco and Grand Bahama experienced difficulty obtaining coverage or saw significant premium increases. Nassau, Paradise Island, and Eleuthera were less affected. Coverage availability should be confirmed before making an offer on Family Island properties.

Mandatory for mortgages: If you finance through a Bahamian bank, comprehensive hurricane insurance is a condition of the loan. Cash buyers should carry it regardless.

Providers: Major Bahamas-based insurers include Bahamas First General Insurance, Security & General Insurance, and Summit Insurance. International insurers such as Lloyd's of London also write Bahamas property policies. Glenn connects buyers with brokers who specialise in island properties and can compare quotes across providers.

Frequently asked questions

Frequently asked questions

Buying Property in The Bahamas — FAQ

Yes. Foreign nationals purchase residential property with the same freehold ownership rights as Bahamian citizens. No income tax, no capital gains tax, no inheritance tax. Developed residential purchases under 2 acres require only BIA registration — no government permit. Undeveloped land over 5 acres and commercial properties may require a permit under the International Persons Landholding Act (IPLA) 1993.

For developed residential property under 2 acres intended for personal use: no permit required — only registration with the Bahamas Investment Authority (BIA). For undeveloped land exceeding 5 acres, commercial properties, and properties in certain designated areas: a BIA permit is required under the IPLA. Glenn coordinates with your attorney to determine which category your purchase falls into.

The IPLA (1993) governs foreign ownership of Bahamas real estate. It establishes the registration and permit framework for non-Bahamian buyers. Key thresholds: developed residential under 2 acres = registration only; undeveloped land over 5 acres = permit required; commercial property = permit required. The Act also requires that all foreign-held property be registered with the BIA regardless of size.

Total buyer-side closing costs are approximately 10–14% of the purchase price. Breakdown: VAT on conveyance (10% for non-Bahamians over $100,000 — commonly split 50/50 with seller, saving you 5%), attorney fees (2.5–3.5% — Bar Association minimum 3.5% for registered land since January 2026), BIA registration fee, title insurance (optional), property inspection, survey, and prorated HOA/utility costs.

No. Stamp duty on real estate conveyances was replaced by VAT on conveyance under the VAT (Amendment) Act 2022, effective 1 July 2022. Foreign buyers pay 10% VAT for purchases over $100,000. Bahamian citizens pay on a sliding scale from 2.5% (under $100K) to 10% (over $1M). The VAT split between buyer and seller is a negotiation point, not a legal requirement.

Yes. Bahamian law requires a local attorney to handle conveyancing — title search across the Registry of Records, Supreme Court Registry, Companies Registry, and Probate Registry; contract preparation; and closing. Fees run 2.5–3.5% of purchase price. The Bahamas Bar Association raised the minimum to 3.5% for registered land effective January 2026, and 5% for unregistered land. Glenn works with trusted attorneys across every price range.

Typically 60–90 days. Timeline: offer negotiation (3–7 days), attorney engagement and title search (2–4 weeks), BIA registration (1–2 weeks), property inspection and survey (1 week), VAT invoice from Comptroller (1–2 weeks), closing and deed registration. Cash purchases can close faster. Mortgage-backed purchases add 4–8 weeks for bank approval.

No. Foreign-incorporated entities (US LLCs, UK LTDs, Canadian corporations) cannot hold Bahamas real estate directly. You can purchase through a Bahamian International Business Company (IBC), but this does not satisfy the EPR personal ownership requirement. Most international buyers purchase in their own name for owner-occupied tax benefits and residency qualification. Glenn advises on the optimal ownership structure.

Effective July 2025, the Act requires that the VAT invoice from the Comptroller of Inland Revenue be obtained and settled before deed execution — previously, this could be done concurrently. It also introduced mandatory registration of conveyances within 180 days. These changes add a procedural step but improve transaction transparency. Glenn’s team builds this into every closing timeline.

Foreign buyers purchasing in foreign currency (USD, GBP, CAD, EUR) do not require Exchange Control approval. If you fund the purchase through a Bahamian bank account in Bahamian dollars, the Central Bank of The Bahamas requires Exchange Control registration for repatriation of sale proceeds when you eventually sell. Glenn coordinates with your attorney on currency structuring.

Without a Bahamian will, your property passes under Bahamian intestacy laws — which may not align with your wishes or your home country’s estate plan. Foreign owners should execute a separate Bahamian will covering only their Bahamas assets. Cost: approximately $350 (increased from $202 effective January 2026). This avoids the need for resealing a foreign probate grant, which is more expensive and time-consuming.

Strongly recommended. A Bahamian will specifically covering your Bahamas real estate ensures your property passes according to your wishes without the delays and costs of resealing a foreign grant of probate. It should be drafted by a Bahamian attorney alongside your purchase. Minimum cost: $350 (Bar Association schedule effective January 2026).

A non-immigrant status document issued to foreign property owners who want to reside in The Bahamas without applying for permanent residency. It does not grant work rights and must be renewed annually. It is separate from EPR (Economic Permanent Residency), which requires a $1M+ property investment and grants permanent status. Glenn advises on which status suits your goals.

Yes. You can sell to Bahamian citizens or other foreign nationals without restriction. The buyer will need to complete their own BIA registration (or permit application if applicable). VAT on conveyance applies to the new transaction. There is no capital gains tax on the sale. If you hold EPR, selling before the 10-year hold period may affect your residency status.

Not required, but recommended. You can fund the purchase via international wire transfer directly to the attorney’s escrow account. However, a local account simplifies ongoing payments (property tax, insurance, HOA, utilities) and is required if you plan to receive rental income in Bahamian dollars. RBC, CIBC FirstCaribbean, and Scotiabank serve foreign account holders.

Why Buy With Glenn Ferguson?

Glenn Ferguson handles the entire buying journey — property search, comparable analysis, negotiation, attorney coordination, closing management, and EPR filing — under one roof. One relationship replaces what typically requires three separate firms (agent, immigration consultant, residency attorney).

Off-market access. Many luxury properties sell before hitting the MLS. Glenn surfaces opportunities across Lyford Cay, Ocean Club, Albany, Old Fort Bay, and the Family Islands through 24 years of relationships that portals simply cannot replicate.

Closed sale intelligence. Portals show asking prices. Glenn provides actual closed prices, $/sqft trends, and days-on-market — the data that drives smart negotiation. The Bahamas has no public closed sale database, so this intelligence is only available through experienced agents.

Full-service search to residency. Property search, HOA review (including rental restriction analysis), detailed cost estimates, attorney coordination, Exchange Control registration, closing management, HORC application, and EPR filing if applicable. No handoff to other firms.

Rental income projections. Property-specific pro-formas with nightly rates, seasonal occupancy, management fees, and net yield — not generic island averages. The difference between a 5% and 8% net yield on a $1.5M property is $45,000 per year.

Multi-island expertise. Nassau, Paradise Island, Cable Beach, Exuma, Eleuthera, Abaco, Grand Bahama. Glenn honestly tells you which island fits your goals — even if it's not the one you originally expected.

International buyer experience. The majority of Glenn's clients are from the US, Canada, UK, and Europe. He understands cross-border considerations including IRS obligations for Americans, HMRC rules for British buyers, and CRA reporting for Canadians, and connects you with specialist international tax advisers.

Glenn Ferguson

Licensed Bahamas real estate agent and residency consultant with over 24 years of experience guiding international buyers through property purchase and Economic Permanent Residency applications. Glenn handles the entire buying journey — property search, comparable analysis, negotiation, attorney coordination, closing management, and EPR filing — under one roof.

BREA #1247 · Bahamas MLS · WPIC-Certified Wedding Planner · Licensed Marriage Officer

BREA #1247 · 24+ Years

BREA #1247 · 24+ Years

Ready to Buy Property in The Bahamas?

Glenn Ferguson — 24+ years, full MLS access, off-market inventory, comparable data, and residency filing. One call starts everything.

WhatsApp Glenn Get Property Shortlist Call 1-242-395-8495Can a Foreigner Buy a House?

Ownership rights, permits, and the complete process for international buyers.

7 Things to Know Before Buying

Critical facts that separate informed buyers from costly mistakes.

2026 Market Report

12.5M visitors, $7B tourism revenue, island-by-island pricing data.

Residency by Investment

$1M EPR threshold, 10-year hold, 90-day presence, tax advantages.

American Investors Guide

FBAR, FATCA, estate tax, FEIE. Complete IRS compliance guide.

British Investors Guide

Non-dom abolition, IHT tail period, SRT, FIG regime. HMRC guide.

Canadian Investors Guide

CRA departure tax, T1135, FAPI, deemed disposition. Full guide.

Get a Tailored List of Bahamas Properties

Tell Glenn what you're looking for and receive a personalised shortlist — including off-market listings not available on any portal.

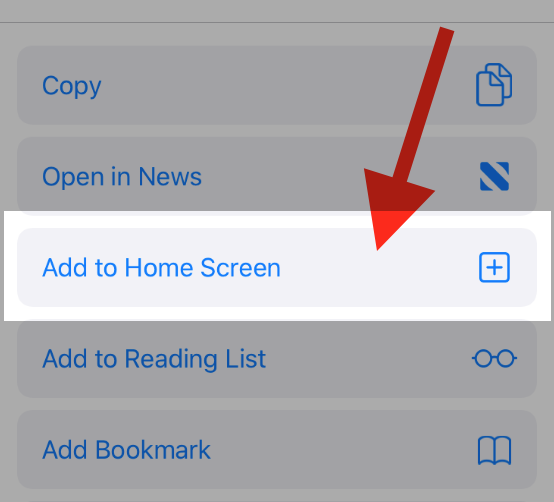

To add this web app to your homescreen, click on the "Share" icon

![]()

Then click on "Add to Home"

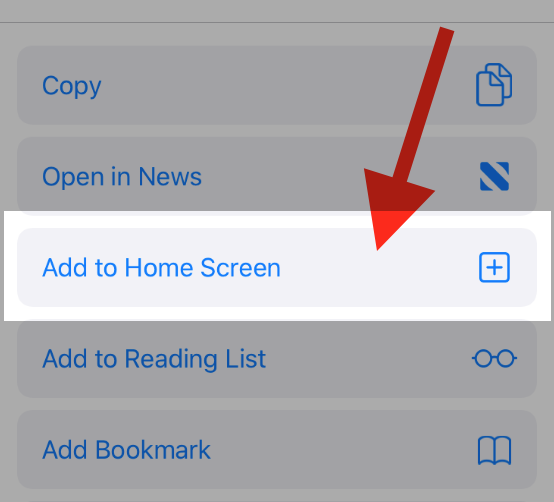

To add this web app to your homescreen, click on the "Share" icon

![]()

Then click on "Add to Home"

It looks like your browser doesn't natively support "Add To Homescreen", or you have disabled it (or maybe you have already added this web app to your applications?)

In any case, please check your browser options and information, thanks!

It looks like your browser doesn't natively support "Add To Homescreen", or you have disabled it (or maybe you have already added this web app to your applications?)

In any case, please check your browser options and information, thanks!